The Macao SAR Government released its Gaming Law Public Consultation Final Report in December, which included some interesting clues as to the government’s views on a proposal to restrict dividend payments.

It should also provide some relief to the global investment community, which has reacted with trepidation at best – and downright panic at worst – ever since the release of the Macau government’s consultation document late on 14 September. As reported by IAG at the time, the initial reaction of investors at the time was a selloff of Macau gaming stocks that wiped away 26% or US$18.4 billion in market capitalization of the Hong Kong listed entities of Macau’s six gaming concessionaires in a single day, 15 September 2021. Much of this panic was caused by six key issues, most of which have since been referenced by the Macau Gaming Inspection and Coordination Bureau (DICJ) or the Secretary for Economy and Finance, either tangentially or more substantively, with hints dropped that the final outcomes might not be nearly as calamaitous as the market initially feared.

“To enable concessionaires to make better use of the benefits obtained from the gaming business in promoting the continuous and diversified development of Macau, it is recommended that when distributing profit, regardless of whether it is paid in the form of cash or equity, concessionaires must meet specific requirements in advance and obtain the prior authorization of the SAR government.”

Of all the consultation document proposals, this “dividend authorization” measure created the most concern, and for very good reason.

PUBLIC OPINION ON THE PROPOSAL

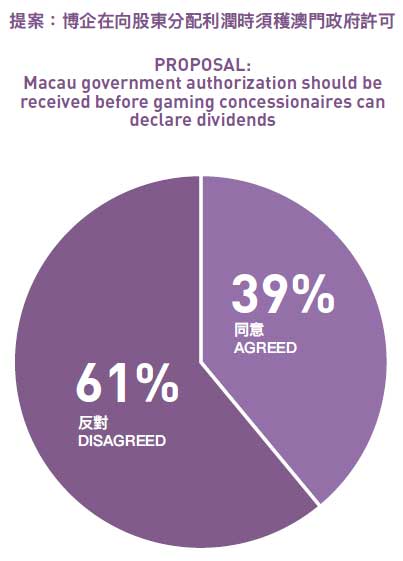

Public opinion during the consultation period to a greater or lesser extent agreed more than it disagreed with the various consultation document proposals – except in the case of the dividend authorization proposal. The final report states that of 46 opinions expressed on this proposal, only 18 (39%) agreed while 28 (61%) disagreed. The Macau government should be commended for its transparency in disclosing opinions which disagreed with the proposal.

GOVERNMENT RESPONSE

GOVERNMENT RESPONSE

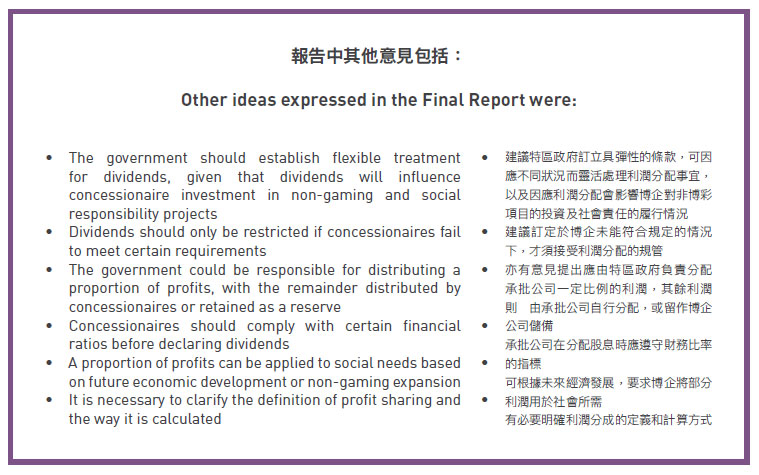

The government provided an analysis of and response to the public’s views on the dividend authorization proposal, some of which were merely in line with the initial consultation document.

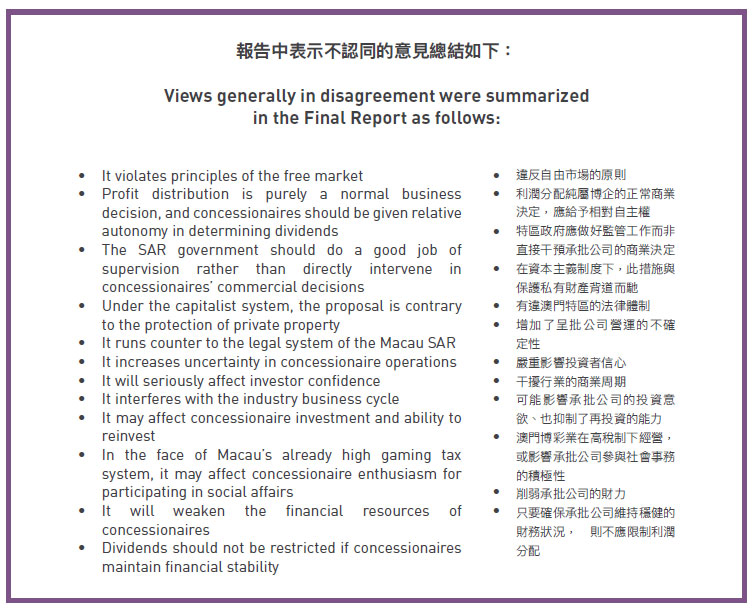

However some new information was forthcoming. The government response noted, “The opinions collected during the consultation period do not agree with the proposed restriction, and the main reasons for disagreement are that it will interfere in free market operations and may affect the investment intentions of concessionaires.

“The SAR government will consider the concerns and suggestions put forward by various stakeholders and comprehensively analyze the overall content of the amendment and evaluate positive and negative impacts … in order to amend the law to protect the relevant interests.”

Did you notice it? The amendment was presented as a fait accompli. The government is saying, “Yes, we hear your objections, but guess what, there’s going to be an amendment to the gaming law on this anyway.”

THE TAKE-AWAY MESSAGE

But here’s the good news. The key take-away sentence in the government response is this, “Measures to restrict dividends are not designed to prevent reasonable profit distributions from normal business practices, but to ensure that the concessionaires have sufficient financial resources to fulfill their obligations stipulated in the law and under the concession contract.”

This is the answer everybody has been waiting on – if it is to be believed. It clarifies that the policy intention is “not designed to prevent reasonable profit distributions from normal business practices.” They just want the concessionaires to be solvent, to have the cash on hand to do what the government wants them to do. So, if you believe this, and you believe that Macau gaming concessionaires have historically had “sufficient financial resources to fulfill their obligations stipulated in the law and under the concession contract,” then you must believe that the proposal to require government authorization for dividends will not amount to any practical change for the Macau operators. This is the first time the government has expressed this clarification and should go a long way to calming the market – if the market is astute enough to read between the lines and receive the message.

Our next step on the road to clarity is to wait until the draft amendment is made public, so that we can see the precise language drafted to give effect to the policy intention. And if our suspicions are correct, we might be seeing that as early as this month.

GOVERNMENT RESPONSE

GOVERNMENT RESPONSE