Shin Hwa World, the owner and operator of Korean integrated resort Jeju Shinhwa World, has reported a loss attributable to the owners of the company of HK$522.4 million (US$66.8 million) in 2023, significantly wider than its 2022 loss of HK$216.9 million (US$27.7 million) due largely to what it says was pressure on the room price and occupancy rate of its hotels due to intense competition and domestic customers travelling abroad after the easing of global travel restrictions.

It also booked a lower win rate at Landing Casino, and therefore a higher gaming segment loss, despite increased turnover in both the mass and VIP sectors. Although Shin Hwa World described the recovery momentum of its gaming business becoming apparent throughout the year, “the decline in the winning percentage resulted in a negative effect on the segment revenue.”

As such, the gaming business recorded net revenue of HK$46.8 million (US$6.0 million) in 2023, up 1.4% year-on-year, but a segment loss of HK$258.4 million (US$33.0 million), widened by some 49%.

In its integrated resort or non-gaming business, Shin Hwa World recorded segment revenue of HK$777.6 million (US$99.4 million), down 17.8% year-on-year, with a widened segment loss of HK$203.7 million (US$26.0 million).

It explained, “During the year, most countries eased their border travel restrictions, and China lifted its ban on group tours to Korea after six-year hiatus in August 2023. Faced with intense competition and domestic customers travelling abroad after the lift of travel restrictions, the room prices and occupancy rates of our hotels were under pressure during the year.

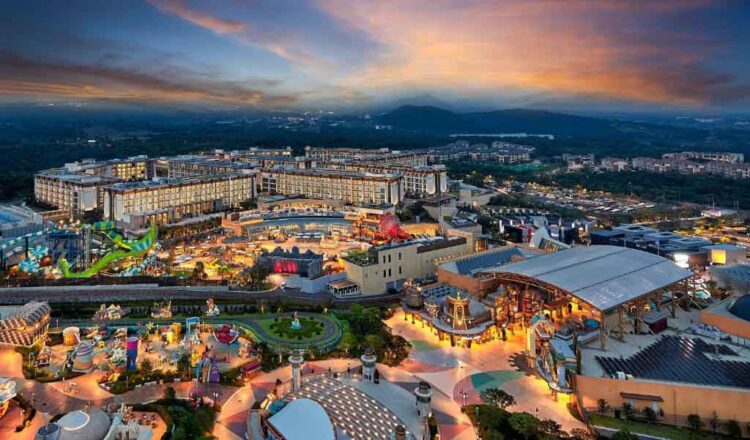

“Nevertheless, our marketing team continued to offer a series of promotional events bundled with our accommodations, water and theme parks, as well as food and beverage options. We also launched a wide variety of attraction events, such as count down concert, lighting show with fireworks, seasonal flea market, art gallery, and new facilities, such as a premium cinema and a media-based story park, to enrich our customers’ experiences.”

Other reasons for the group-wide loss in 2023 included a decrease in residential property sales owing to the downturn in the property market and the interest rate rise; an increase in marketing expenses and operating expenses resulting from inflation, particularly utility costs and facilities maintenance costs, as well as an increase in employee benefit expenses; and an absence of a net amount of approximately HK$63 million from the reversal of trade and other receivables impairment recorded in the previous financial year.

Given the challenging conditions, which also saw the company dump a long-held plan to develop an integrated resort in Manila, Shin Hwa World said it would now focus all of its financial energies on its Korean IR.

“High interest rates, inflation, the war in Ukraine, as well as Gaza-Israel conflict, continue to weigh on global economic activities,” it said. “The rise in interest rate has dampened the rebound of global economy, and the markets expect interest rate cuts in 2024. However, it is believed that interest rates will remain high for some time, and the forthcoming years will remain challenging for the Group.

“Taking these macro factors into consideration, the Group will remain cautious in capital commitments and will act prudently in future development and investment plans in order to maintain a healthy liquidity position.”